Original Medicare (Part A and Part B, which are administered by the federal government) covers a wide array of both inpatient and outpatient services and equipment.

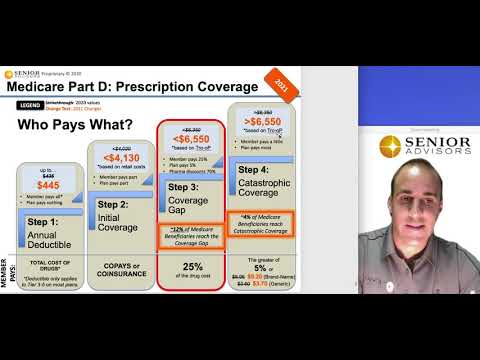

Part D deductible: If a Part D Deductible is required, the plan cannot exceed the standard yearly deductible of $445 in 2021. Plan carriers may set the deductible lower and many MA-PD plans exempt Tiers 1, 2, and 3 from the deductible and offer first dollar coverage for these drugs. Maximum out of Pocket: All Medicare Advantage Plans must have. Have you heard of Medicare deductible? It’s just the annual payment that you have to make plus the premium for the Original Medicare plan. You should know that Medicare deductible 2021 will be higher than what you pay right now. If you don’t pay the annual deductible, you won’t get any coverage. So, it’s quite essential for you to pay. Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $445 in 2021. Some Medicare drug plans don't have a deductible.

So do you really need anything else?

Consider the fact that over 38 million Americans are enrolled in Original Medicare (fee-for-service Medicare).1 Of those beneficiaries, 13.5 million belong to a Medicare Supplement Insurance (Medigap) plan. This accounts for 35 percent of all FFS Medicare beneficiaries.2

The numbers don’t lie: many Medicare beneficiaries want something more than just their Original Medicare insurance coverage alone. Could a Medicare Supplement plan be worth it for you?

Medicare Out-of-Pocket Costs Can Add Up Quick

Medicare Supplement Insurance helps pay for some of the out-of-pocket expenses that Medicare Part A and Part B don’t cover.

Original Medicare has deductibles, coinsurance and copayments that can all add up quickly. Without a Medigap plan, you may have to face these and other Medicare costs yourself. And it’s important to note that medical bills are the leading cause of bankruptcy in the U.S.3

Medicare Supplement Plans May Help

Medicare Part A helps cover your hospital costs if you are admitted as an inpatient.

So if you need to stay in the hospital, your costs are all set, right? Not so fast.

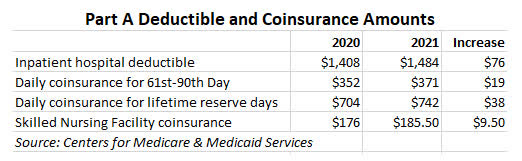

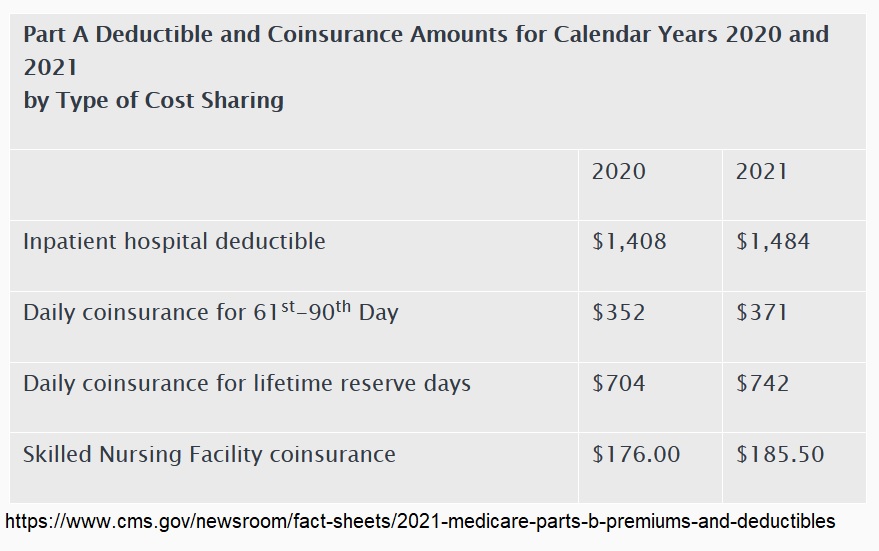

First, you’ll have to satisfy a deductible of $1,484 per benefit period in 2021 before any of your Part A coverage kicks in.

And while it’s not likely, you could potentially face multiple benefit periods in a year. If so, you’d have to meet the Part A deductible again each time you’re admitted for a new benefit period.

You’re hardly in the clear once you meet the deductible either. If your hospital stay extends beyond 60 days (which isn’t typical), you’ll begin daily copayments of $371per day in 2021.

If you stay in the hospital for more than 90 days, you have to pay $742 per day in 2021 until your 60 lifetime reserve days are used up. After that point, you’re responsible for all of your hospital costs for the rest of the year.

Each of the 10 standardized Medicare Supplement Insurance plans available in most states provide full coverage of Medicare Part A coinsurance, and some plans help cover the Part A deductible.

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020.

You can use the chart below to compare the out-of-pocket costs that each type of standardized Medigap plan will cover in 2019.

Click here to view enlarged chartScroll to the right to continue reading the chart

Medicare Supplement Benefits

Part A coinsurance and hospital coverage

Part B coinsurance or copayment

Part A hospice care coinsurance or copayment

First 3 pints of blood

Skilled nursing facility coinsurance

Part A deductible

Part B deductible

Part B excess charges

Foreign travel emergency

| A | B | C* | D | F1* | G1 | K2 | L3 | M | N4 |

|---|---|---|---|---|---|---|---|---|---|

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | 50% | |||||||

| 80% | 80% | 80% | 80% | 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

+ Read more1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission.

- Read lessMedigap Plans May Give You More Cost Predictability

Many medical bills cannot be anticipated, and it can be difficult to budget for unpredictable health care costs.

Medicare Supplement plans can give you more predictability with your health care costs in exchange for a set monthly premium.

By knowing that certain out-of-pocket Medicare costs will be covered, you may be better set up to budget and protect yourself from “surprise” medical bills.

Original Medicare Doesn’t Include an Out-of-Pocket Spending Limit

Under Original Medicare, there is no out-of-pocket spending limit. That means you could potentially face Medicare costs that continue to pile up. A Medigap plan may help alleviate that concern.

Additionally, two Medigap plans – Plan K and Plan L – include an annual out-of-pocket spending limit. Once you reach this limit in a calendar year, the plan then pays for 100% of all covered out-of-pocket costs for the remainder of the year.

What is “First-Dollar” Coverage?

Part A and Part B of Medicare require you to first meet a deductible before your coverage kicks in.

Medigap Plan F and Plan C provide full coverage for the Part A and Part B deductibles in 2021. This means your Medicare coverage will kick in at your very first appointment for Medicare-covered services. This is called “first-dollar coverage.”

Starting on January 1, 2020, Medigap plans won’t be allowed to provide “first-dollar” coverage to new beneficiaries by covering both the Part A and Part B deductibles. This means that new Medicare beneficiaries who become eligible for Medicare after Jan. 1, 2020, won’t be able to enroll in Plan F or Plan C.

If you are eligible for Medicare before Jan. 1, 2020, you may be able to enroll in Plan F or Plan C after 2020, but only if either plan is offered where you live.

If you already have Plan F or Plan C before 2020, you will be able to keep your plan.

Some Medigap Plans Help Cover Emergency Care When You Travel Abroad

Original Medicare doesn’t typically cover emergency care that you receive when traveling outside of the United States.

Some Medigap plans, however, can provide coverage for 80 percent of your foreign travel emergency care costs. This can help give you a sense of security when you take your next trip around the world.

The Medigap plans that include foreign travel emergency care coverage in 2019 are:

What Does Medicare Supplement Insurance Cover?

There are nine benefit areas that can be covered by the standardized Medicare Supplement Insurance plans.

These costs include:

- Part A coinsurance and hospital costs

Part A coinsurance can reach as high as $742 per day in 2021. - Part B coinsurance or copayments

After meeting your deductible, you generally pay 20 percent of the Medicare-approved amount for services and items covered by Part B. - First three pints of blood needed for a blood transfusion

Original Medicare only covers the cost of blood beginning with the fourth pint, so you have to pay out-of-pocket for the first three. - Part A hospice care coinsurance or copayments

Part A often requires small copayments for prescription drugs used for hospice care as well as coinsurance for respite care. - Coinsurance for skilled nursing facility

If a stay in a skilled nursing facility goes beyond 20 days, you must pay a coinsurance payment of $185.50 per day in 2021. If the stay lasts longer than 100 days, you’re responsible for all costs. - Part A deductible

Medicare Part A requires a $1,484 deductible for each benefit period in 2021. A benefit period begins the day you are admitted to a hospital or skilled nursing facility as an inpatient and ends once you have not received inpatient care for 60 consecutive days. - Part B deductible

Part B requires an annual deductible of $203 in 2021. - Part B excess charges

Health care providers who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for their services or items. - Foreign travel emergency care

There are only a few rare circumstances under which Original Medicare provides any coverage for emergency care received outside of the U.S.

How Much Does a Medicare Supplement Insurance Plan Cost?

The cost of Medicare Supplement Insurance can vary based on your location, the type of plan you have, the insurance carrier who provides your plan, your smoking status and even your age.

In 2019, the average monthly premium paid for Medigap plan was $126 per month.4

Am I Eligible for a Medicare Supplement Plan?

You must be enrolled in both Medicare Part A and Part B before you can buy a Medigap plan.

If you are under 65 years of age and are qualified for Medicare because of a disability, you may or may not be able to purchase a plan, depending on the state in which you live.

When Should I Buy a Medicare Supplement Insurance Plan?

The day you are both 65 years old and enrolled in Medicare Part B, you’ll begin your Medigap Open Enrollment Period (OEP). This is the best time to enroll in a Medigap plan.

If you sign up for Medigap during this time, the insurance company that carries your Medigap plan is not allowed to charge you higher rates based on your health.

You may still be able to sign up for a Medigap plan outside of your Medigap OEP, but you may have to undergo medical underwriting. The underwriting process could lead to the insurance company charging you higher rates – or denying you a Medicare Supplement Insurance policy altogether – based on your health.

Some states have additional underwriting protections that may give you the same or similar benefits to your Medigap OEP. Check with your state’s department of insurance to learn more.

There are several Medigap guaranteed issue rights outside of your Medigap OEP that may allow you to sign up for a Medigap plan without medical underwriting. Your plan type options may be limited depending on the guaranteed issue right you have.

During the first 30 days that a Medigap plan is in effect, it may be cancelled for a full refund. After 30 days, you may still cancel at any time for no refund.

If you’re thinking about changing Medigap plans, you can use a 30-day “free look” period to try out a different plan and then choose between the two plans at the end of the period.

You’ll have to pay the premiums for each plan during the free look period.

Get Help Choosing a Medicare Supplement Insurance Plan

Not every Medicare Supplement Insurance plan will be available in every location.

A licensed insurance agent can help you compare each of the Medigap plans that are available in your location. A licensed agent can discuss your coverage needs with you and help you comb through the details of each available plan, including their costs, benefits and more.

Last year, we helped 40,000 people find a Medicare Supplement Insurance plan.5 Call today so we can help you, too.

A licensed insurance agent can help you compare the costs and coverage of Medicare Supplement Insurance plans that are available where you live.

Compare Medigap plans in your area.

Find a plan1 CMS. Medicare Enrollment Dashboard. Retrieved Aug. 2019, from www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Dashboard/Medicare-Enrollment/Enrollment%20Dashboard.html.

2 AHIP. The State of Medigap 2019. (May, 2019). Retrieved from www.ahip.org/wp-content/uploads/IB_StateofMedigap2019.pdf.

3 Cornish, Lorie. This is the real reason most Americans file for bankruptcy. (Feb. 11, 2019). CNBC. Retrieved from https://www.cnbc.com/2019/02/11/this-is-the-real-reason-most-americans-file-for-bankruptcy.html.

4 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

5 According to TRANZACT internal data estimating that 40,253 Medicare Supplement Insurance policies were placed in 2018.

Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

Resource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?

New to Medicare? Compare Medicare plan costs in your area.

Or call 1-800-557-60591-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

How much does Medicare cost in 2021? It’s a simple question with a complex set of answers.

This guide details the average costs of each part of Medicare in 2021. This includes:

- Original Medicare (Part A and Part B)

- Medicare Advantage plans (Part C)

- Stand-alone Medicare prescription drug plans (Part D)

- Medicare Supplement Insurance plans (Medigap).

What will Medicare Part A cost in 2021?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities.

Part A can include a number of costs, including premiums, a deductible and coinsurance.

2021 Part A premiums

There are two important things to keep in mind about Part A premiums:

- Most people qualify for premium-free Part A.

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters). Those 40 quarters do not have to be consecutive. - If you pay a premium for Part A, your premium could be up to $471 per month in 2021.

If you paid Medicare taxes for only 30-39 quarters, your 2021 Part A premium will be $259 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $471 per month.

2021 Part A deductible

If you are admitted to a hospital for inpatient treatment, Medicare Part A helps cover your hospital costs once you reach your Medicare Part A deductible. The Part A deductible is $1,484 per benefit period in 2021.

The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year.

2021 Part A coinsurance

After you meet your Part A deductible, you may be required to pay Part A coinsurance for extended hospital stays.

For the first 60 days of your hospital stay, you aren’t required to pay Part A coinsurance.

But beginning on day 61 of your stay in 2021, you’re required to make a Medicare Part A coinsurance payment of $371 per day through day 90. After your 90th day in the hospital, you must pay $742 per day for up to 60 more days in 2021.

Those 60 “lifetime reserve days” do not reset annually. They can only be used once.

Beyond that, you are responsible for all costs.

Part A also requires coinsurance for hospice care and skilled nursing facility care.

- Part A hospice care coinsurance or copayment

Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs. - Skilled nursing facility care coinsurance

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is the cost of Medicare Part B for 2021?

Medicare Part B covers medical insurance benefits and includes monthly premiums, an annual deductible, coinsurance and other potential costs.

2021 Part B premiums

The standard monthly premium for Medicare Part B is $148.50 per month in 2021.

Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

People who had higher income in 2019 may pay higher Part B premiums, which is called the IRMAA (Income-related Monthly Adjustment Amount).

The 2021 Part B premium breakdown is below.

| 2019 Individual tax return | 2019 Joint tax return | 2019 Married and separate tax return | 2021 Part B monthly premium |

|---|---|---|---|

$88,000 or less | $176,000 or less | $88,000 or less | $148.50 |

More than $88,000 and up to $111,000 | More than $176,000 and up to $222,000 | N/A | $207.90 |

More than $111,000 up to $138,000 | More than $222,000 up to $276,000 | N/A | $297.00 |

More than $138,000 up to $165,000 | More than $276,000 up to $330,000 | N/A | $386.10 |

More than $165,000 up to $500,000 | More than $330,000 up to $750,000 | More than $88,000 up to $412,000 | $475.20 |

More than or equal to $500,000 | More than or equal to $750,000 | More than or equal to $412,000 | $504.90 |

2021 Part B deductible

You must meet your Part B deductible before Part B pays its share of most covered services (the deductible doesn’t apply to certain preventative services), for example:

- Most doctor services

- Outpatient therapy

The 2021 Part B deductible is $203 per year.

2021 Part B coinsurance or copayment

Once you meet your Part B deductible for the year, you typically pay 20 percent of the Medicare-approved amount for services that are covered by Part B.

Is There A Yearly Deductible For Medicare

Part B late enrollment penalty

If you don’t sign up for Medicare Part B when you’re first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2021 standard premium for Part B is $148.50 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $14.85 per month to your Part B premium.

Medicare Part B Premium 2021

Part B excess charges

If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

These additional costs are called Medicare Part B excess charges, and they can potentially add up to thousands of dollars.

How much does Medicare Advantage cost per month?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month.1

Depending on your location, $0 premium plans may be available in your area.

Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare Advantage plans include additional benefits that Original Medicare doesn’t cover.

Because Medicare Advantage plans are sold by private insurance companies, plan costs (such as coinsurance, copayments and deductibles) can vary based on location, carrier, benefits offered and more.

Find out the average cost of Medicare Advantage plans in your state.

Medicare Advantage Special Needs Plans (SNP) may have lower costs

A Medicare Special Needs Plan (SNP) is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans (DSNP).

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Cancer

- Cardiovascular disorders

- Chronic heart failure

- Dementia

- Diabetes mellitus

- End-stage liver disease

- End-Stage Renal Disease (ESRD) that requires dialysis

- Severe hematologic disorders

- HIV/AIDS

- Chronic lung disorders

- Strokes

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Medicare Advantage plans have an out-of-pocket spending max

When you enroll in a Medicare Advantage plan, you can ask about your specific policy’s out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While it’s not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

What is the average cost of Medicare Part D prescription drug plans?

In 2021, the average monthly premium for a Medicare Part D plan is $41.64 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA (Income-related Monthly Adjustment Amount).

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago (2019).

| 2019 Individual tax return | 2019 Joint tax return | 2019 Married and separate tax return | 2021 Part D monthly premium |

|---|---|---|---|

$88,000 or less | $176,000 or less | $88,000 or less | Your plan premium |

More than $88,000 and up to $111,000 | More than $176,000 and up to $222,000 | N/A | $12.30 + your plan premium |

More than $111,000 up to $138,000 | More than $222,000 up to $276,000 | N/A | $31.80 + your plan premium |

More than $138,000 up to $165,000 | More than $276,000 up to $330,000 | N/A | $51.20 + your plan premium |

More than $165,000 up to $500,000 | More than $330,000 up to $750,000 | More than $88,000 up to $412,000 | $70.70 + your plan premium |

More than or equal to $500,000 | More than or equal to $750,000 | More than or equal to $412,000 | $77.10 + your plan premium |

Medicare Part D deductible

Medicare Part D plans cannot have a deductible of more than $445 per year in 2021.

Some Medicare Part D plans have a $0 deductible. In 2021, the average Part D deductible is $342.97 for the year.1

Annual Deductible For Medicare 2021

Medicare Part D “donut hole” coverage gap costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a “donut hole” or “coverage gap,” which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

What is the average cost of Medicare Supplement Insurance (Medigap)?

The average premium paid for a Medicare Supplement Insurance (Medigap) plan in 2019 was $125.93 per month.3

It’s important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses you’ll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medicare High F Deductible 2021

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

Click here to view enlarged chartMedicare Deductible For 2021

Scroll to the right to continue reading the chart| Medicare Supplement Benefits | A | B | C* | D | F1* | G1 | K2 | L3 | M | N4 |

|---|---|---|---|---|---|---|---|---|---|---|

| Part A coinsurance and hospital coverage | ||||||||||

| Part B coinsurance or copayment | 50% | 75% | ||||||||

| Part A hospice care coinsurance or copayment | 50% | 75% | ||||||||

| First 3 pints of blood | 50% | 75% | ||||||||

| Skilled nursing facility coinsurance | 50% | 75% | ||||||||

| Part A deductible | 50% | 75% | 50% | |||||||

| Part B deductible | ||||||||||

| Part B excess charges | ||||||||||

| Foreign travel emergency | 80% | 80% | 80% | 80% | 80% | 80% |

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission.+ Read more

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Compare Medicare Advantage plan costs in your area

A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

Plan G High Deductible 2021

Or call 1-800-557-60591-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Learn more about Medicare enrollment

Medicare Premiums 2021 Brackets

1 MedicareAdvantage.com's The Best States for Medicare in 2021 report. (Oct. 27, 2020).

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.